AGA published its Commercial Gaming Revenue Tracker for February 2022

2 minutos de lectura

(United States).- The American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker features state-by-state and nationwide financial performance data with breakdowns for individual gaming verticals.

February 2022 Commercial Gaming Revenue

U.S. commercial gaming revenue continued its strong start in 2022 with the highest-grossing February on record. February revenue was driven by the continued growth of slot revenue and sustained strength of sports betting and iGaming.

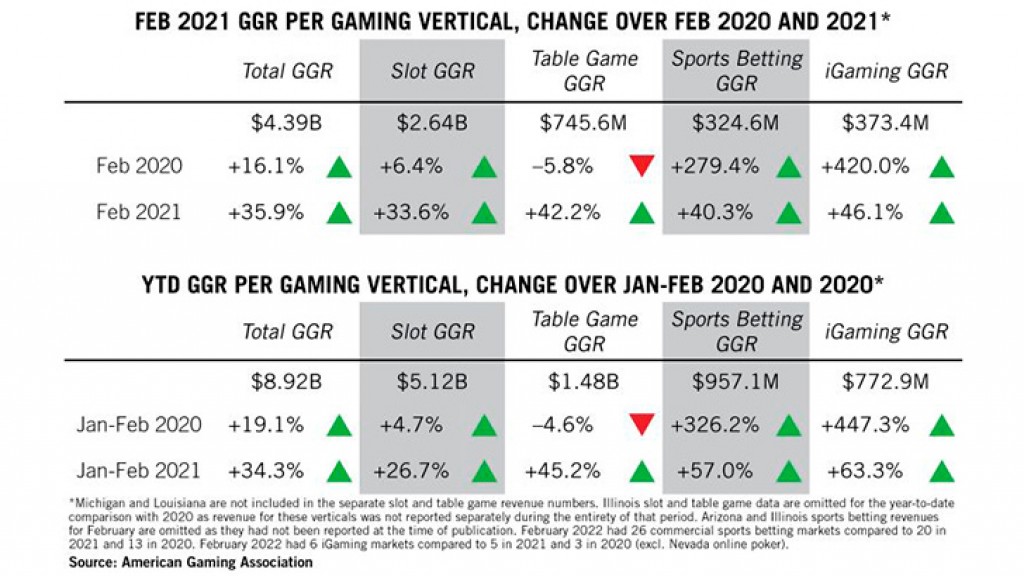

In February, combined commercial gaming revenue from land-based casino games, sports betting and internet gaming reached $4.39 billion, up 16.1 percent from February 2020—the last full pre-pandemic month of casino operations—and up 35.9 percent from a year ago. Sequentially, revenue dropped 3.1 percent as sports betting win nearly halved compared to January. February also marked 12 straight months with $4B or more in revenue—a milestone that had not happened prior to 2021.

2022 has seen the industry’s fastest ever start to a year, with $8.92 billion in commercial gaming revenue generated in the first two months, up more than 19 percent from the previous record set in 2020.

Eighteen of 27 commercial gaming states that were operational two years ago saw revenue growth from February 2020.

Notably, only five states are behind their gaming revenue pace at the start of 2020: Kansas (-11.7%), Louisiana (-2.3%), New Mexico (-6.4%), Oklahoma (-5.2%) and Rhode Island (-13.3%). The lower win for the two Rhode Island casinos reflects, in large part, the highly competitive environment of New England after Encore Boston Harbor opened in June 2019, while Kansas casinos continue to feel the impact of added competition from a new tribal gaming facility close to the state’s largest commercial casino.

Casino visitation levels remained largely unchanged from recent months with admissions in Illinois, Iowa, Louisiana, Mississippi and Missouri increasing on average 21.8 percent from February 2021, when casino operations remained limited from COVID-restrictions. Compared to February 2020—the last pre-pandemic month—visitation was down an average of 25.0 percent across the five midwestern and southern states.

Destination markets experienced a similar dynamic. Las Vegas visitation contracted by 21.5 percent from February 2020, but was 69.9 percent higher than a year ago, according to the Las Vegas Convention and Visitors Authority.

With lower overall visitation compared to pre-pandemic levels, commercial gaming revenue growth is driven by increased average gaming revenue per casino admission. Average casino revenue per visitor in 2022 is up by about 34.2 percent across the five reporting states.

The overall rise in spend-per-visit isn’t enough to offset overall visitation declines in all states. Illinois and Louisiana saw an overall decline in traditional casino gaming revenue compared to pre-pandemic levels, despite higher spending per visit.

Combined casino revenue from land-based slot machines and table games grew in 14 of 25 states through the first two months of 2022 compared to 2020. In February, traditional casino games generated combined revenue of $3.68 billion nationwide, up 34.4 percent versus the same month last year and 1.7 percent from 2020. Slot revenue gained 6.4 percent from February 2020 to $2.64 billion, while table games generated $745.6 million, a 5.8 percent drop over 2020.

In February, commercial gaming revenue from sports betting and iGaming continued to grow, though the pace of sports wagering growth slowed due to a quieter sports calendar.

In February, land-based and online sportsbooks generated $324.6 million in revenue from commercial operations in 26 states. This is a 40.3 percent gain from 2021 when commercial sports betting markets were live across 20 markets.

On a sequential basis, sports betting revenue declined 48.7 percent as the end to the NFL season brought a lull in sports betting activity between Super Bowl LVI—with an estimated event handle of $7.61 billion—and the start of the NCAA Basketball Championship. The month-over-month revenue comparison was also impacted by a lower hold percentage: bettors nationwide kept 95.2 percent of the $6.77 billion U.S. handle, compared to 93.6 percent of $9.84 billion wagered in January. The figures for February will improve somewhat when Arizona and Illinois data is released.

Meanwhile, revenue from iGaming in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia reached $373.4 million in February, dipping 6.5 percent from January’s record but increasing 46.1 percent year-over-year. February 2022 had six iGaming markets compared to five in 2021 and three in 2020 (excluding Nevada online poker).

Taken together, revenue from iGaming and sports betting accounted for 15.9 percent of combined commercial gaming revenue in February—the lowest share total revenue since August 2021.

Categoría:Gaming

Tags: Sin tags

País: United States

Event

SBC Summit Americas 2025

13 de May 2025

Uplatform Aims to Redefine iGaming Success with Networking, Localization, and Customer Journey Mapping

(Fort Lauderdale, SoloAzar Exclusive).- At SBC Summit Americas, Uplatform emphasized the power of strategic networking, data-driven localization and CJM to help operators thrive in the competitive iGaming market. María, Head of Marketing, shares how understanding regional nuances and focusing on overlooked player touchpoints can elevate brands from mere presence to lasting trust. Dive into her insights on industry trends, innovation, and why creativity is a rare gem in expos.

Monday 16 Jun 2025 / 12:00

ProntoPaga Drives the Fintech Revolution with SmartPIX and SmartRouting in LATAM

(Fort Lauderdale, SoloAzar Exclusive).- Evans Concha, CTO and Founder of Pronto Paga, shared the main innovations launched this year and how they impact the regional fintech industry. With a firm commitment to new technologies and cybersecurity, the company is positioning itself as a leader in the sector. Discover how it is redefining the future of digital payments in this article.

Friday 13 Jun 2025 / 12:00

Pay4Fun consolidates its position as a 100% Pix Payment Gateway and expands its reach in LatAm

(Fort Lauderdale, SoloAzar Exclusive).- Pay4Fun strengthens its position as a 100% Pix payment gateway with direct integration with the Central Bank, guaranteeing maximum security and efficiency in transactions. At SBC Summit Americas, Leonardo Baptista highlights the role of networking and innovation in an environment where technology and regulation are key. Discover how Pay4Fun is shaping the future of digital payments.

Thursday 12 Jun 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.